By the Numbers

2024 Financial Information

Making grants from our donor advised funds and developing tax credit programs for our donors created many opportunities for the Community Foundation to serve the Endless Mountains. This is our report to our communities for the year 2024.

2024 was a busy year for our Foundation. Our assets reached 35 million dollars. Our revenue increased to almost 13 million dollars, and the total value of our grants was $7,175,000, a 42% increase over last year. These results are due to the strong support from our donors and the incredible work of our staff. But as impressive as our numbers are, equally important are the ways we helped individuals and organizations in Northeastern Pennsylvania. After you review the numbers in this report, please read the articles that demonstrate how we connect with our communities and how we collaborate with the people living there.

As the Community Foundation has grown in assets and grant making, we have also increased the area that we serve. In 2018 we re-named our corporation Commonwealth Charitable Management, Inc., and established three divisions. The first division is the Community Foundation of the Endless Mountains which focuses on northeast Pennsylvania with donor advised funds and funds for organizations. The second division is Commonwealth Tax Credit Programs which administers a variety of state tax credit programs that build organizations and resources throughout Pennsylvania. The newest division, Commonwealth Development Group, works with other organizations to develop and fund their programs. All of these entities are supported by the same staff and the same board of directors. The reports that are presented here are consolidated for the entire corporation. When we refer to the Community Foundation, we are including the entire corporation.

Earle Wootton

Chairman of The Community Foundation

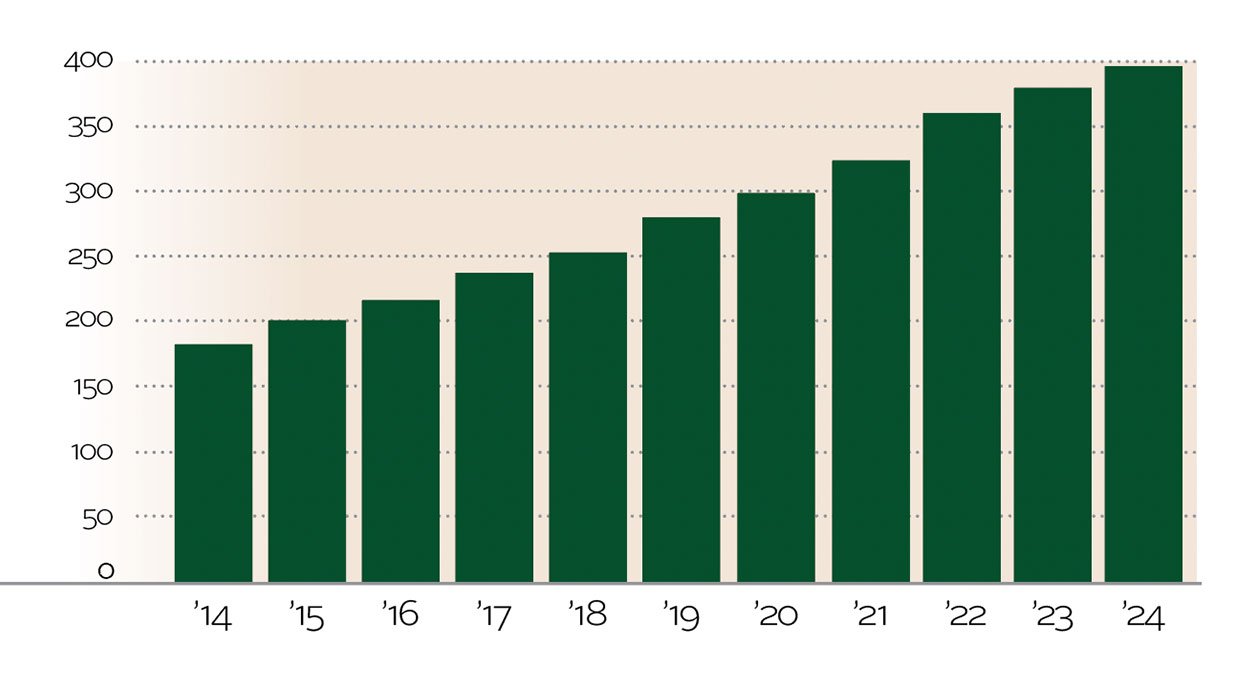

NUMBER OF FUNDS

The number of funds held at year end increased by 18 to a total of 397. The growth is in line with prior years. The average size of a fund increased by 10.8% to $70,469. Each of our funds is controlled by the donor. Some funds allow the donor to change the beneficiary of the fund annually.

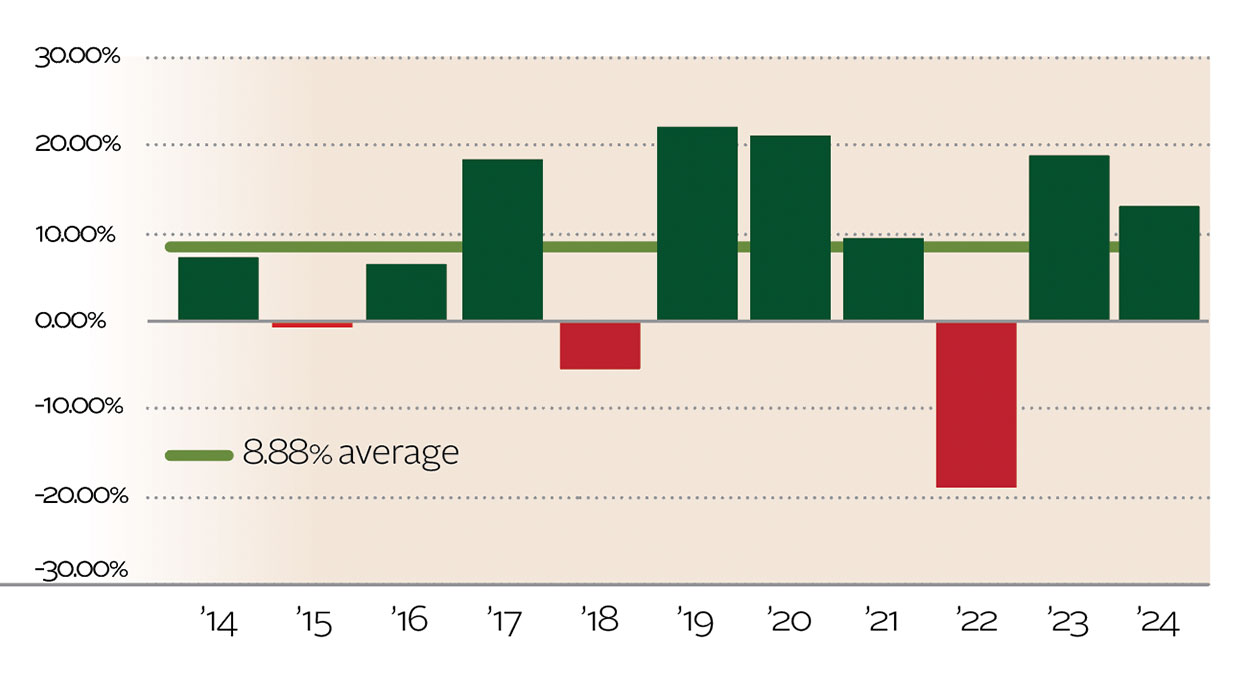

INVESTMENT RETURN

The investment return for all funds was 12.40%. The balanced investment portfolio returned 9.7%. This fund is invested in both stocks and bonds in a ratio of 60%:40% and includes international investments. Our average return over a period of ten years for the balanced investment portfolio is 8.88%.

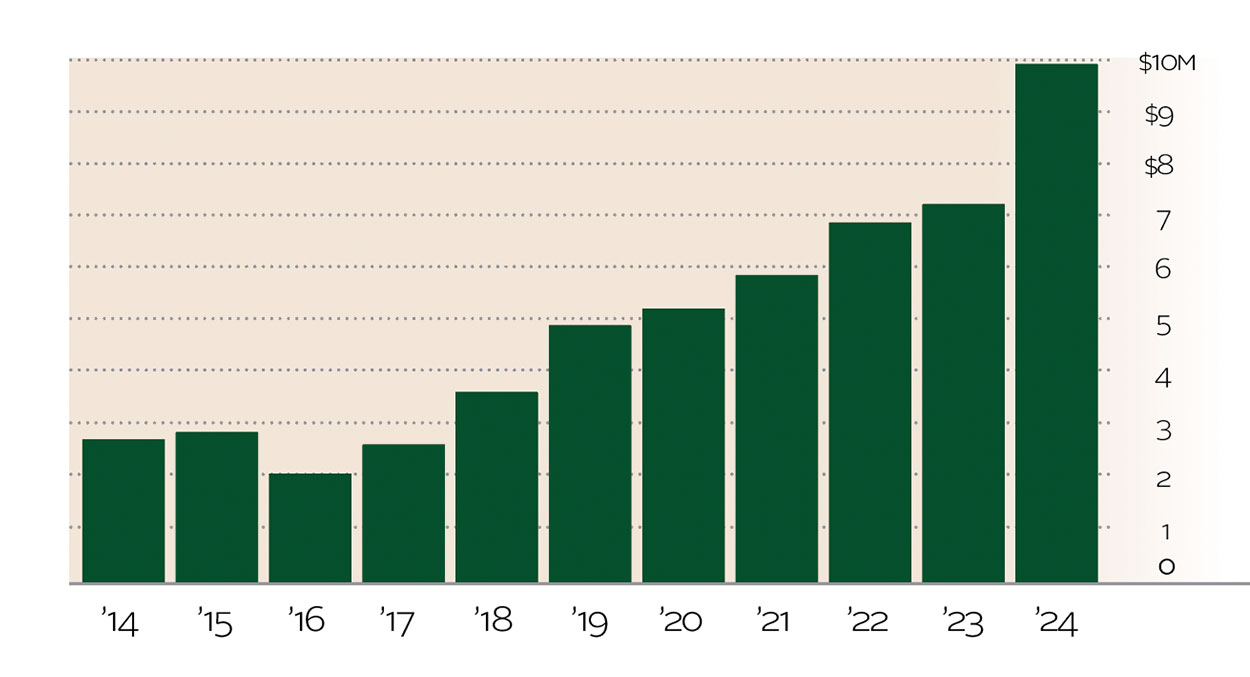

CONTRIBUTION REVENUE

Contribution revenue is the total revenue less investment revenue. This year contribution revenue increased by $2,717,088 or 37.5% to $9,955,078. These funds are primarily donations that will create new funds or add to existing funds.

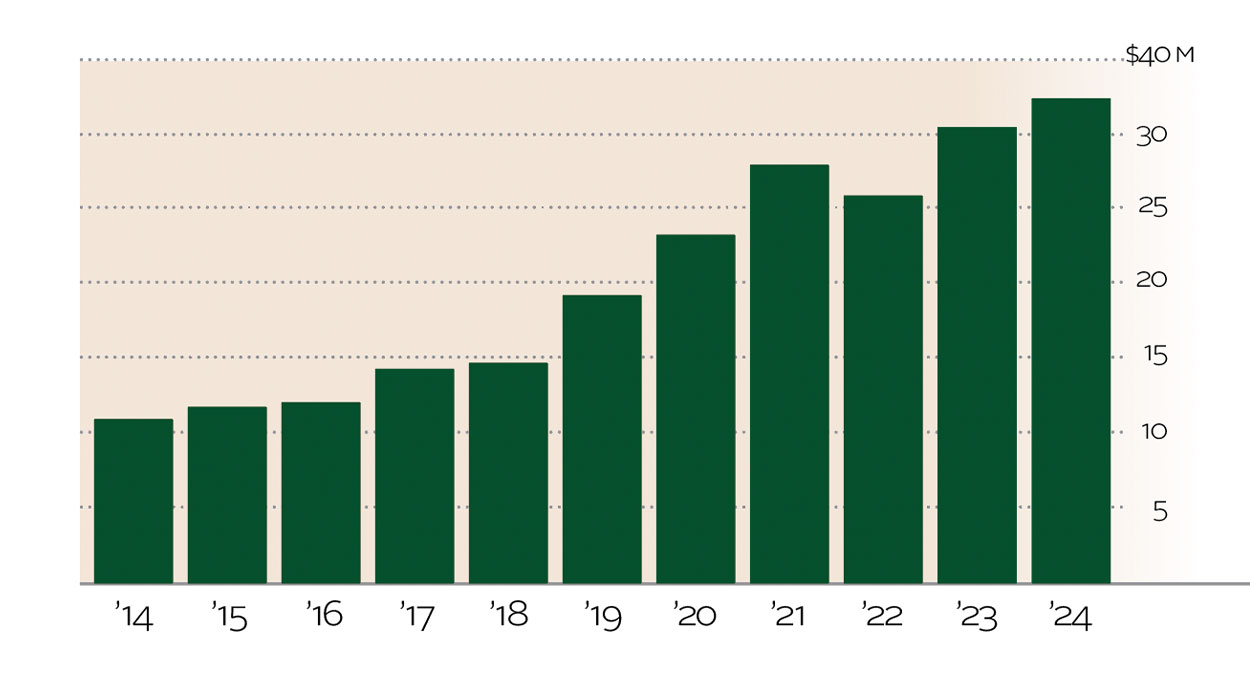

TOTAL ASSETS

The total assets of the Community Foundation rose 14.9% or $4,529,794 to an all-time high of $34,991,048. This growth of over 4½ million dollars is by far our largest yearly growth. The growth is the result of developing new types of programs that benefit organizations throughout the state. The majority of our impact remains in Northeastern Pennsylvania.

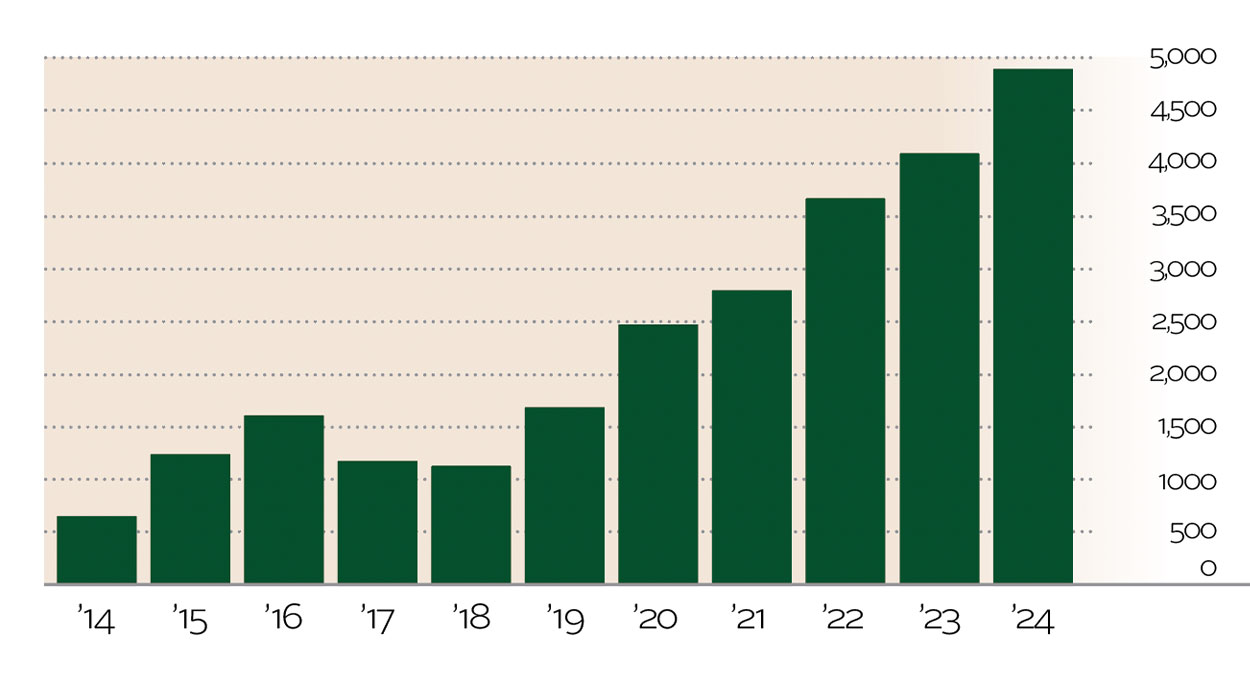

NUMBER OF GRANTS

The number of grants that were made throughout 2024 was 4,848, an increase of 673 or 16.1% over the number of grants in 2023. The average size of a grant increased 22.3% to $1,480. About 2/3 of these grants were made through a taxcredit program which allow the donors to have much greater impact for the dollars they give.

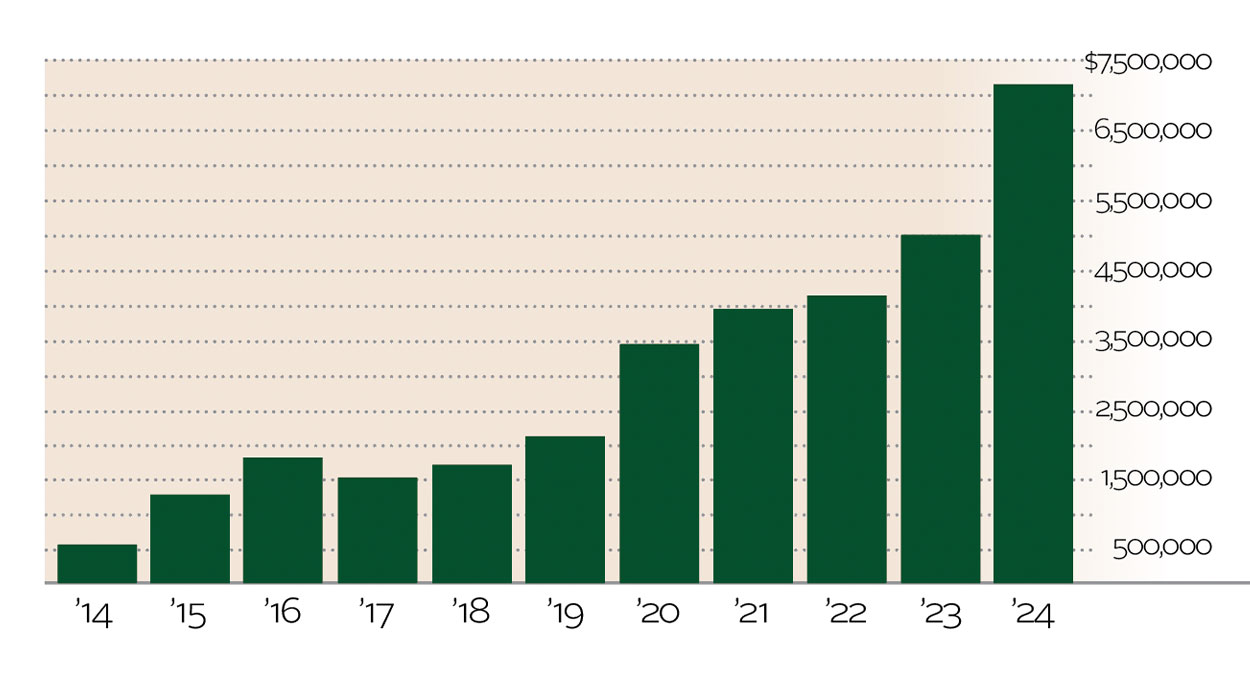

TOTAL VALUE OF GRANTS

The value of all grants increased 42% to $7,174,801. This was an increase of $2,210,799 over the value of grants in 2023. The majority of grants are in Northeastern Pennsylvania with the greatest concentration in Susquehanna and Wyoming Counties.

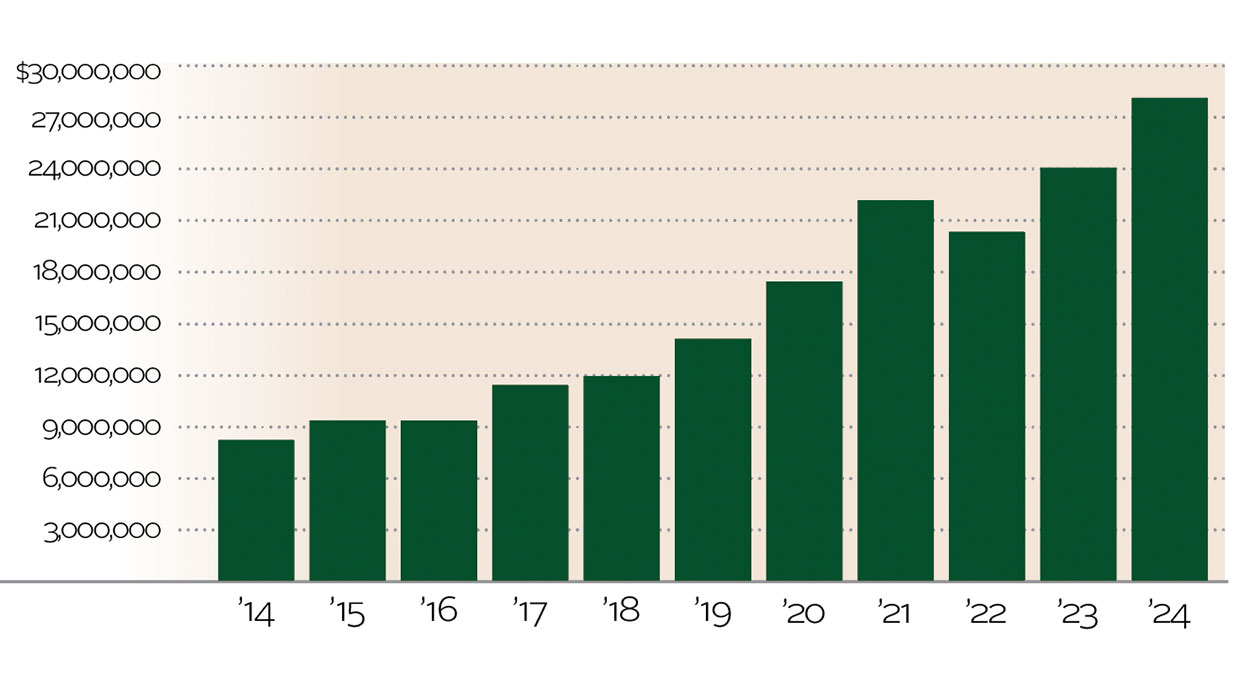

ENDOWMENT ASSETS

Each fund has an individual investment account. The total of all investment accounts is $27,976,378 which is an increase of $3,864,567 or 16.0% over the total at the end of last year. These individual accounts are invested in a variety of mutual funds which provide the greatest diversification and therefore the greatest safety.

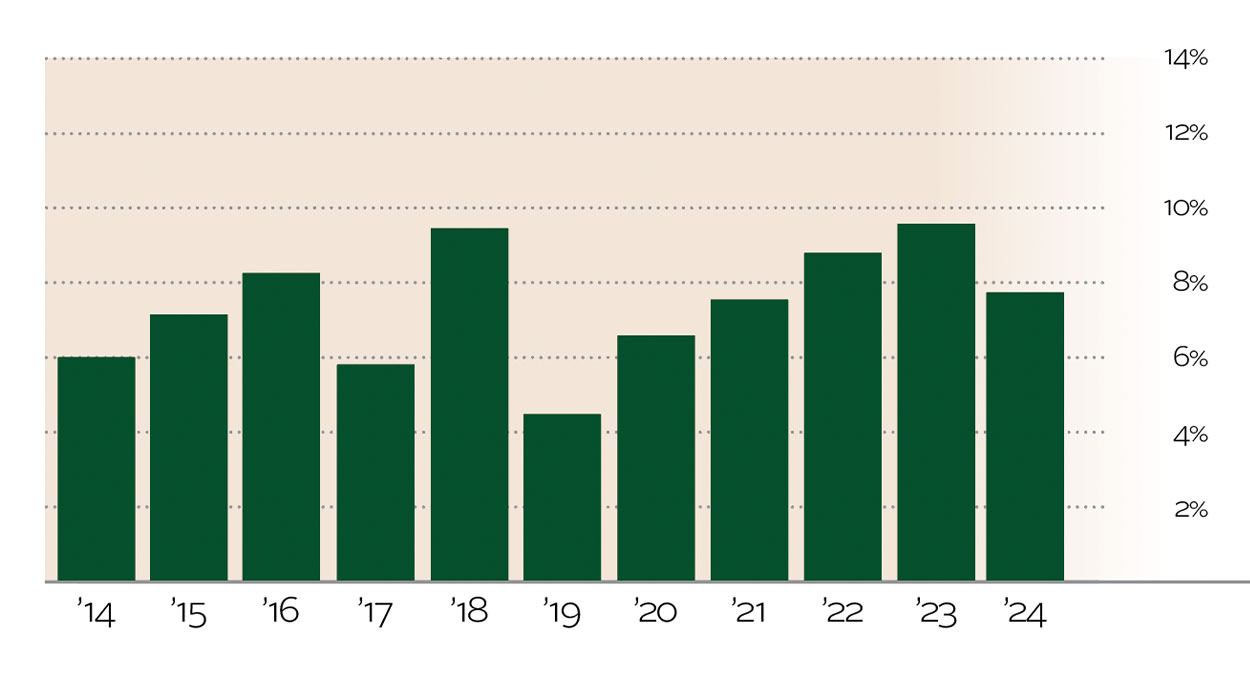

OPERATING EXPENSE RATIO

The operating expense ratio is the operating expense divided by the contribution income. This is a measure of what it costs to run the foundation. This ratio is 7.74% which means that the Foundation spends less than 8 cents for every dollar it raises.