By the Numbers

2023 Financial Information

Our total annual revenue for 2023 consisted of donations that were made to create new funds or to add to existing ones, revenue to support various projects and programs, and interest on our investments. This annual revenue exceeded $11 million. This is our highest amount of revenue ever received in one year surpassing our next highest year, 2021, by over 2 million dollars.

During 2023, grants were made for scholarships, projects and programs. We made 4,175 grants that had a combined value of over $5 million. The money left after our grantmaking is held in funds controlled by donors for future granting. These funds comprise most of our assets, which increased to over $30 million. As the Community Foundation grew in assets and grant making, we also increased the geographical area that we serve. In 2018 we renamed our corporation Commonwealth Charitable Management, Inc., and established three divisions. The first division is the Community Foundation of the Endless Mountains, which focuses on Northeastern Pennsylvania, creating donor advised funds and funds for organizations. The second division is Commonwealth Tax Credit Programs, which administers tax credit programs that build organizations and resources throughout Pennsylvania. The newest division, Commonwealth Development Group, works with other organizations to develop and fund their programs. All these entities are supported by the same staff and board of directors. The reports presented here are consolidated for the entire corporation.

Earle Wootton

Chairman of The Community Foundation

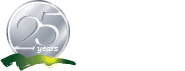

NUMBER OF FUNDS

The number of funds at the Community Foundation increased to 379, an increase of 19. The average value of a fund, $63,000, increased over 21%. The trend to larger funds requires more staff and more technology to ensure better service for our donors. These larger funds frequently have multiple goals and more complex transactions.

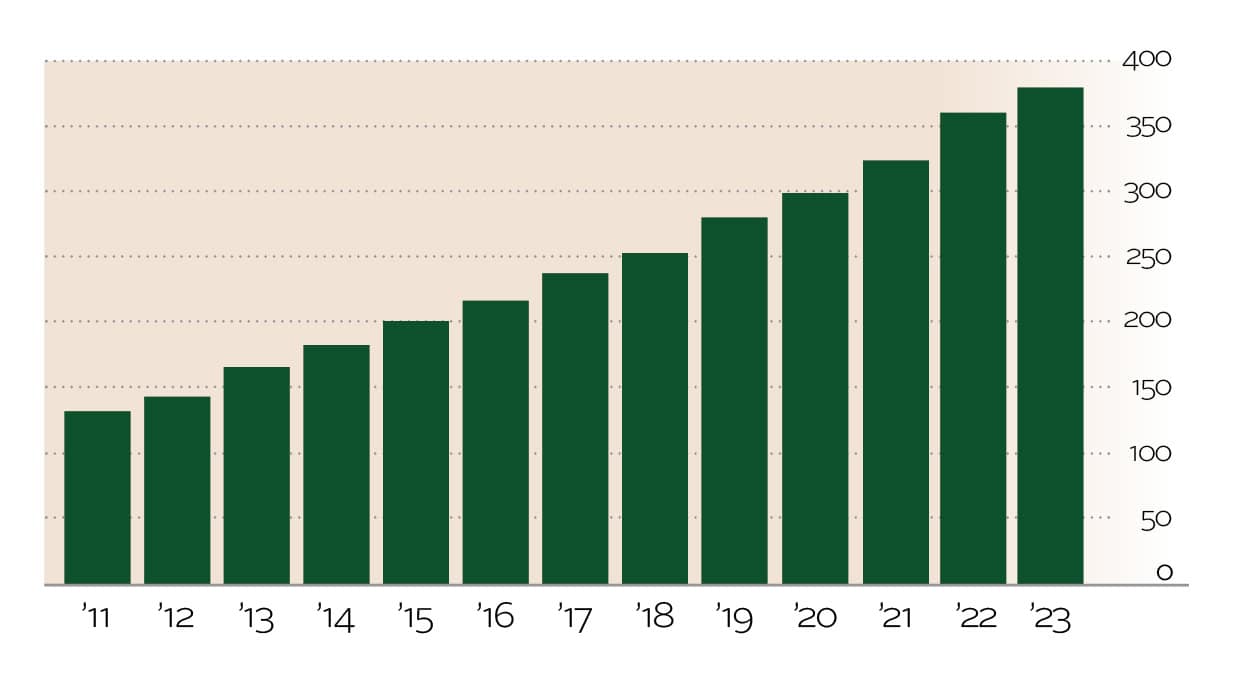

INVESTMENT RETURN

The Investment Return, 17.11%, was a large improvement over the 17.99% loss we suffered in the previous year. These large changes in investment returns must be anticipated and are unavoidable. Our investment accounts hold both stocks and bonds, in a ratio of 60/40. This is a common way to invest funds for long-term stability, and this approach has yielded a high reward recently. Our average investment return, including the past year, is 8.71 % after all investment and administrative costs.

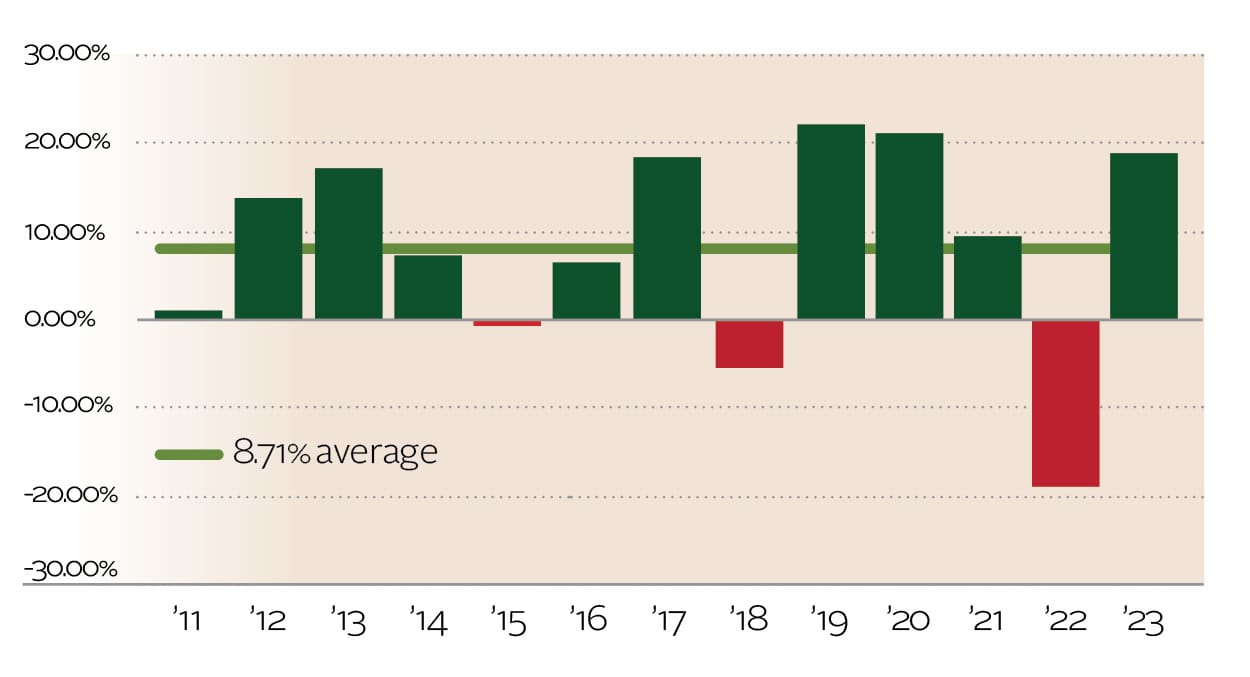

CONTRIBUTION INCOME

The Contribution Income is the amount of income received from all sources except investment income. Since the annual return on our investments cannot be controlled yearly, Contribution Income is a more objective way to evaluate our organization’s annual performance. In 2023 our Contribution Income was $7,248,592, an increase over the prior year of nearly one half million dollars.

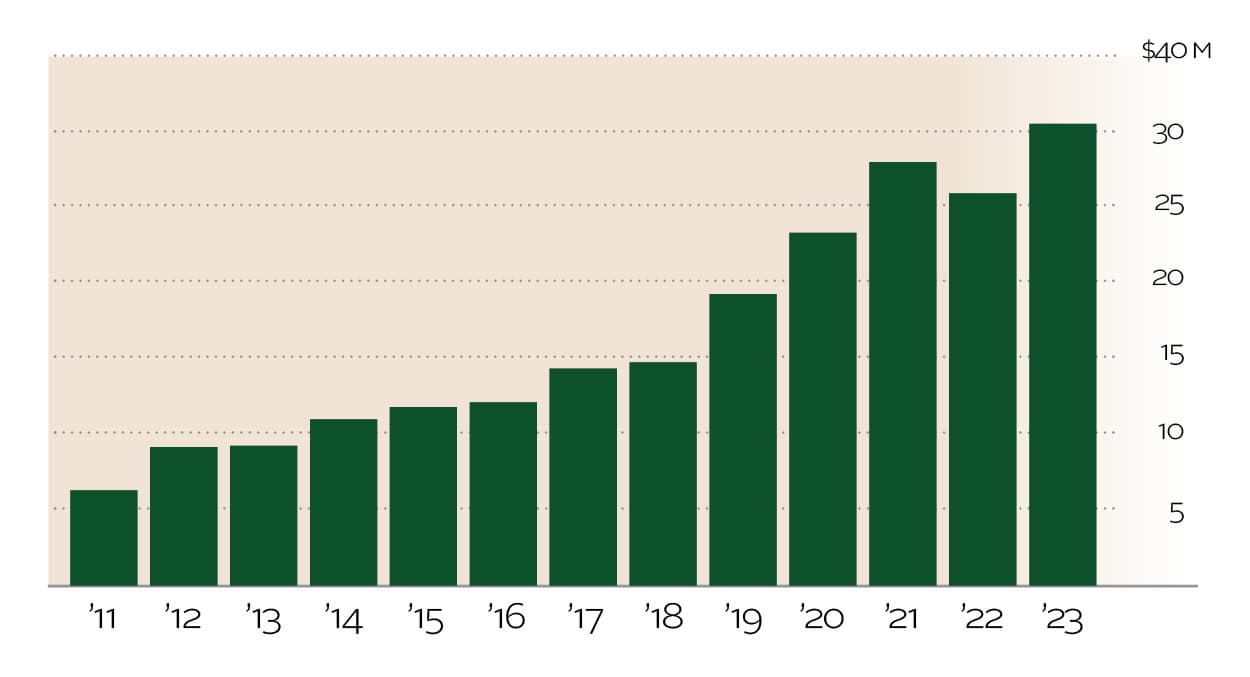

TOTAL ASSETS

Our Total Assets reached $30,461,254, a 20.8% increase over the previous year and a record amount for the Foundation. The increase in our assets has been accelerated through collaboration with other organizations that benefit from our expertise in charitable management. A good investment return and the creation of many new funds increased our total assets.

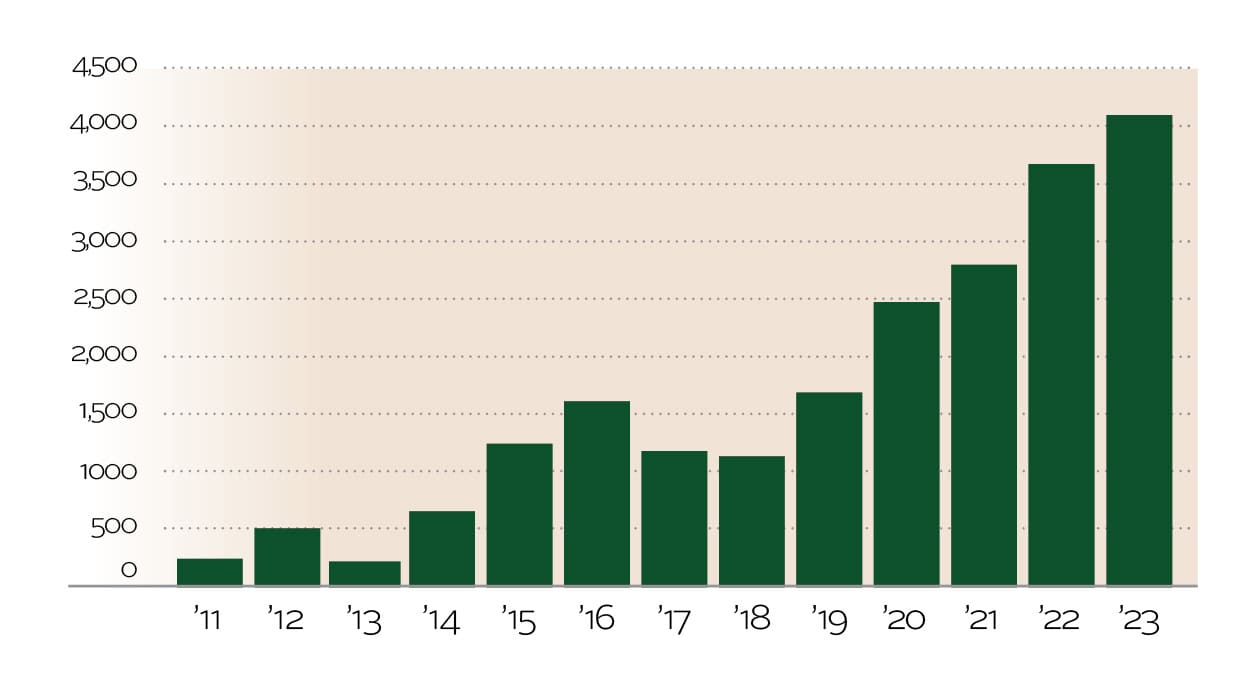

NUMBER OF GRANTS

The number of grants totaled 4,175, an increase in the year 2023 of 515 or 14.1%. This is a record number of grants, and it is the result of serving many more schools and other organizations. Nearly 200 schools received scholarships. These scholarships pay for many kinds of tuition for specialized training, vocational schools, college credit awarded to high school students and traditional post-secondary college curricula.

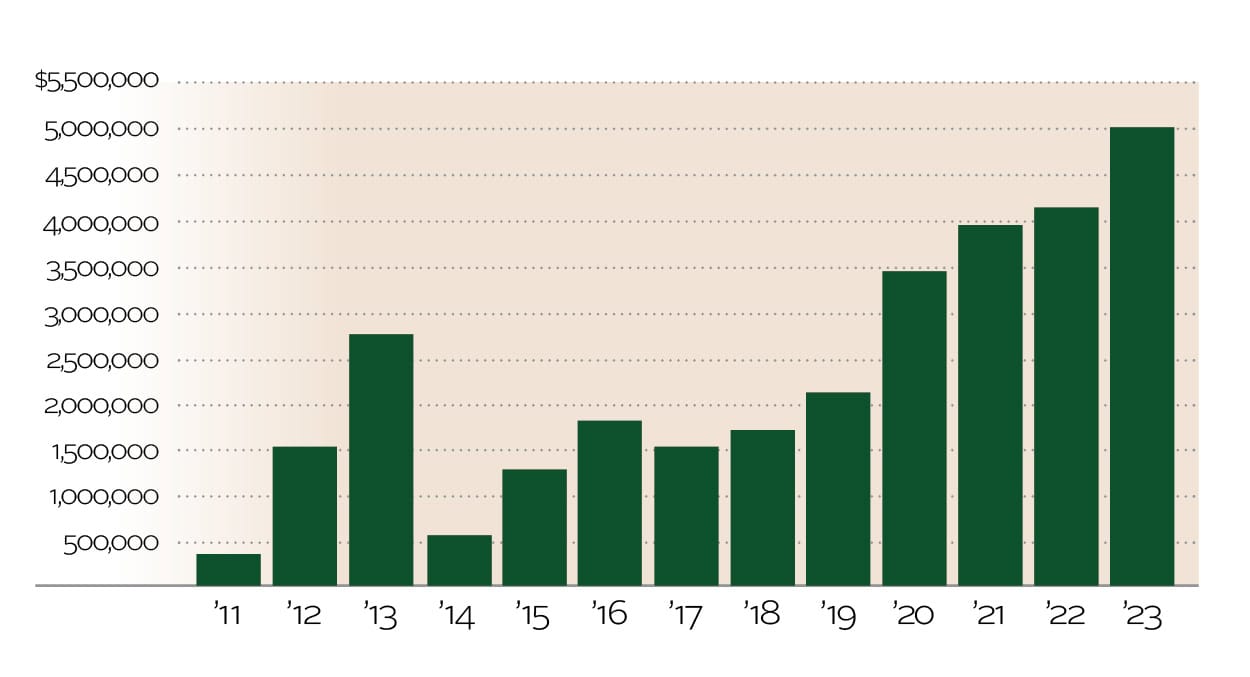

TOTAL VALUE OF GRANTS

The total value of all grants exceeded $5,054,002, which was the largest amount of grants ever awarded, surpassing 2022 by 21%. Many of the grants were scholarships, although other non-profit organizations and charitable causes also received funding. Most of the financial support was concentrated in the northeastern part of our state, but there is an increasing level of participation from schools and other organizations throughout the Commonwealth.

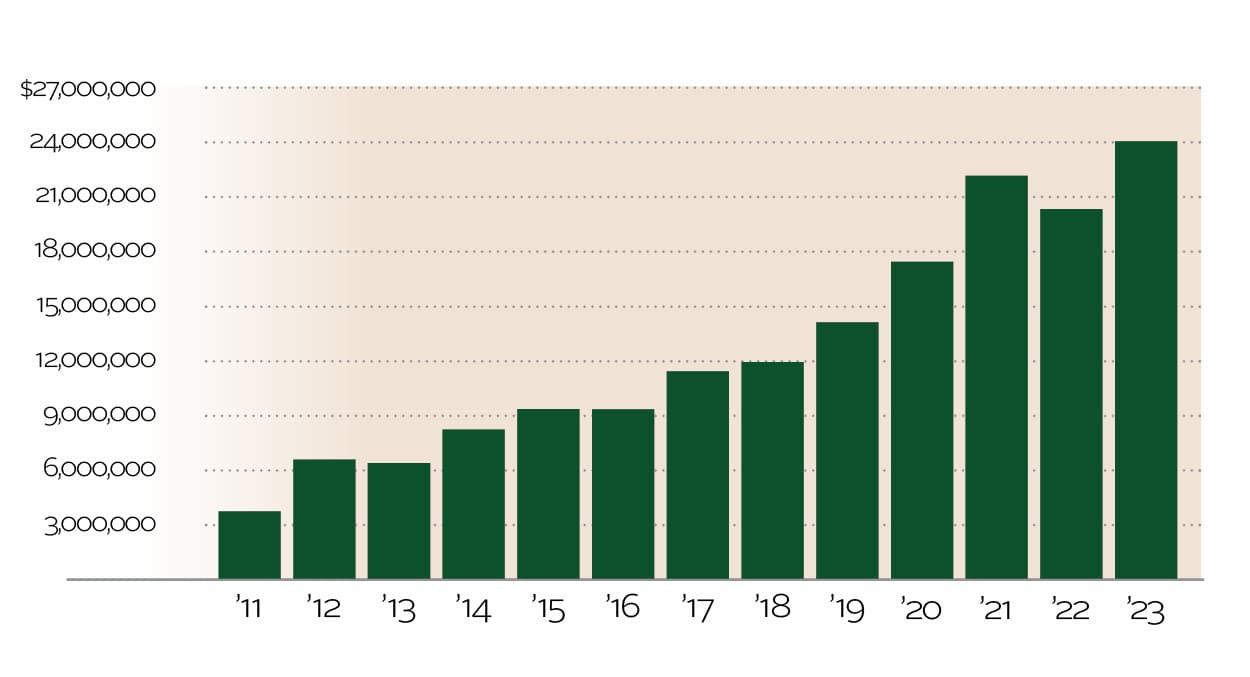

ENDOWMENT ASSETS

Our Endowment Assets, $24,044,294, is the amount of money that is invested for all our funds. This is an increase of 27.5% over the previous year. Each of our funds is individually managed so the timing of a grant by one fund does not affect the value of other funds. Our funds are invested in several mutual funds to create diversification. This ensures the greatest amount of safety for our endowments.

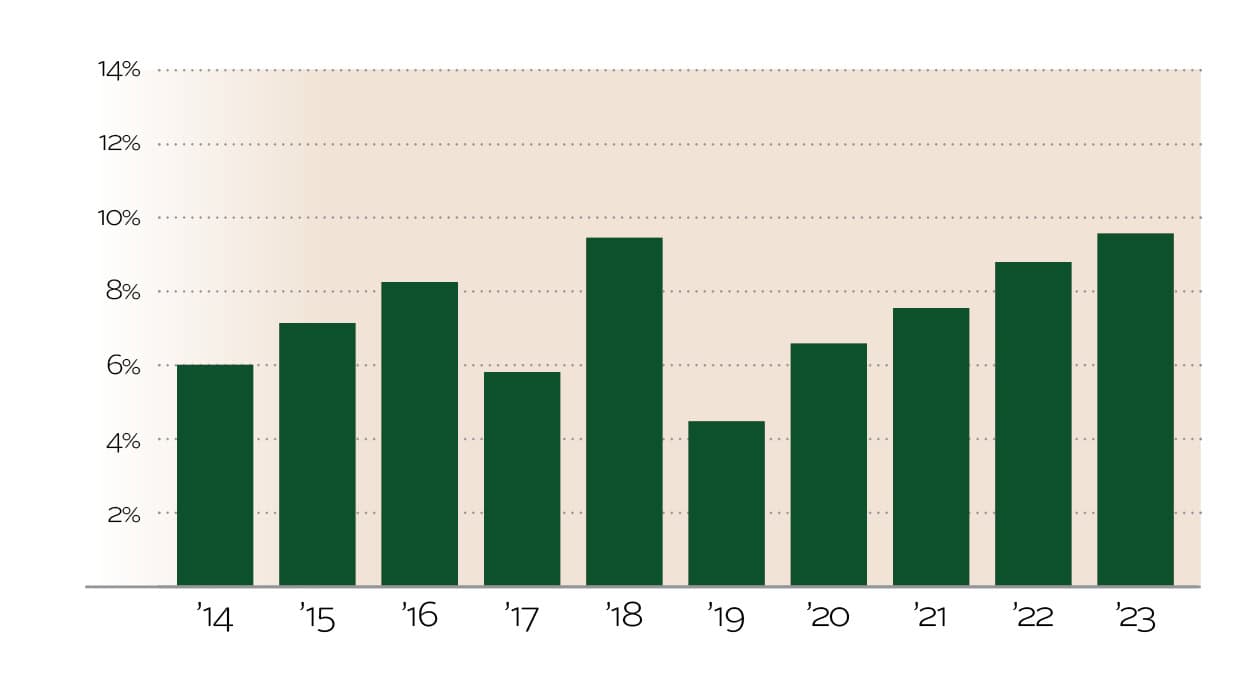

OPERATING EXPENSE RATIO

This ratio reflects the amount of money spent on the operations of the Community Foundation compared to Contribution Income. This ratio, 9.5%, increased slightly in 2023 but is still well below the average of most nonprofit organizations. As the Foundation serves more schools, we are working in a much larger geographical area. To efficiently serve this larger area, we are developing technology that allows us to work with schools, other non-profits and donors more easily and at a lower cost.